Disclaimer: This is not financial advice. For financial and investment advice, see a certified financial advisor.

For those who support nuclear power as a critical part of the clean energy future, it can be challenging to find ways to directly invest in the nuclear renaissance. While many environmental, social, and governance (ESG) funds embrace renewable energy sources like wind and solar, attitudes toward nuclear power remain mixed, and at times hostile, in the financial world.

Until there is broader acceptance of nuclear power, much of the impetus for conscious investment will fall on individuals. Luckily there are several publicly traded companies that are leading the charge to unleash a nuclear renaissance in the U.S. Here are a few of our favorites:

1. General Electric (GE) and Hitachi

In 2007 GE and Hitachi formed a nuclear alliance called GE Hitachi (GEH). Since that time these industrial giants have been at the forefront of advanced nuclear reactor design. GEH is partnering with TerraPower on a sodium fast reactor project in Wyoming, called Natrium. This project, which is a part of the Department of Energy’s Advanced Reactor Demonstration Program, is expected to break ground later in 2024 with a reactor coming online in 2030.

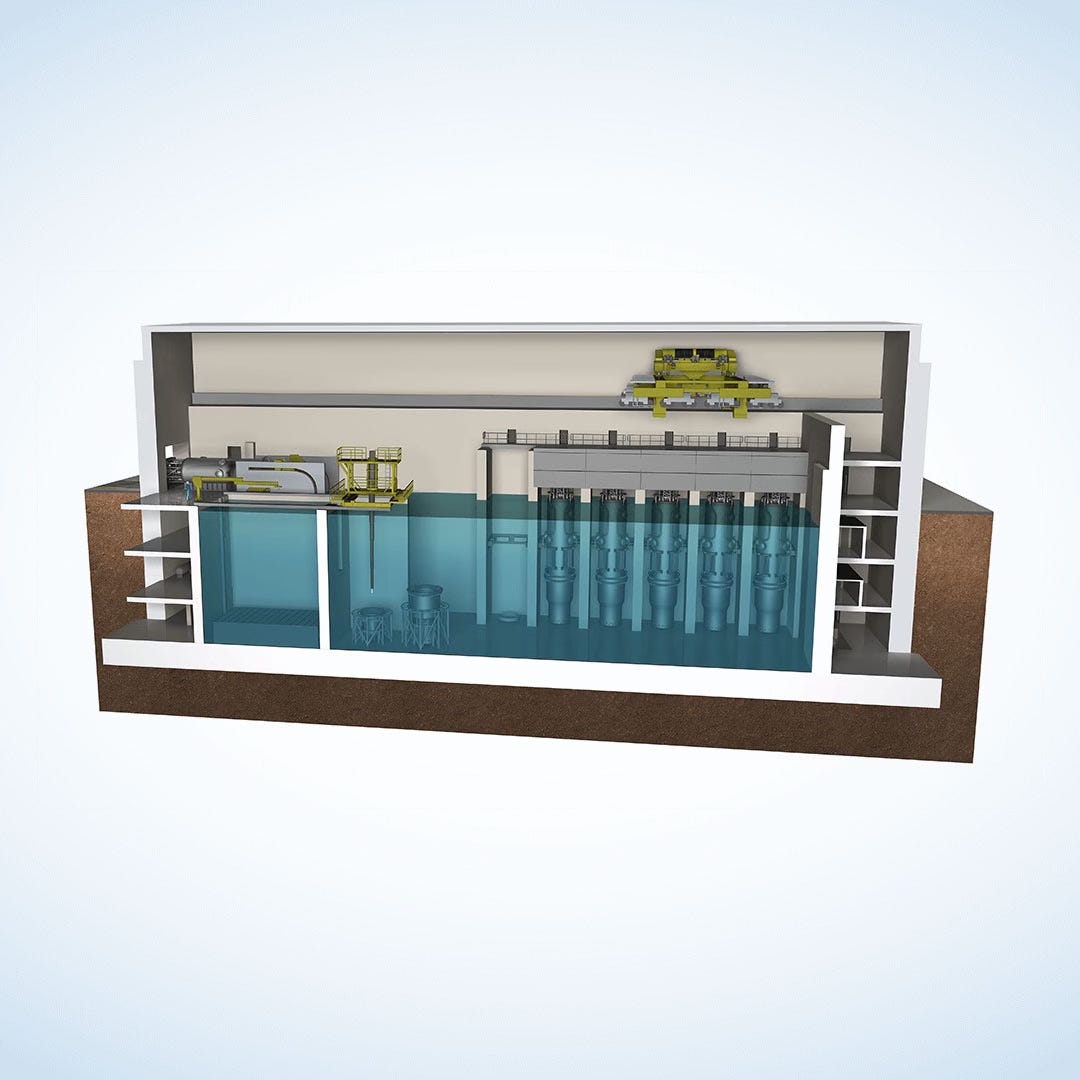

GE Hitachi is also teaming up with Tennessee Valley Authority, Ontario Power Generation, and Synthos Green Energy to advance the global deployment of the GEH BWRX-300 (Boiling Water Reactor, 10th iteration, 300 MWe) small modular reactor (SMR). Through this partnership, each contributor will fund a portion of the overall cost of the SMR with the “purpose of ensuring the standard design is deployable in multiple jurisdictions.” Initially, the goal of this collaboration is to license and deploy a BWRX-300 in the U.S., Canada, and Poland before bringing the technology to other markets.

A large share (48% in 2023) of General Electric’s revenue comes from the design and production of commercial and military aircraft engines, integrated engine components, electric power, and mechanical aircraft systems. However, the company is looking to divest from this sector and invest in its new clean power spinoff GE Vernova.

2. Constellation Energy

As the largest nuclear operator in the U.S., Constellation is playing a pivotal role in advancing America’s nuclear future. The company recently announced that it had raised $900 million for the country’s first green nuclear bond. The company will use the bond to finance plant expansions, upgrades, and license extensions. Constellation is also aiming to tap into subsidies from the Inflation Reduction Act by producing hydrogen with its fleet of nuclear power plants.

Important policy reforms in Illinois may also spell good news for the energy company. Last year Illinois, which is home to six nuclear power plants (all of which are owned by Constellation, lifted its decades-long moratorium on new nuclear power construction. While the bill only permits the construction of power plants of 300 megawatts and less, the lift allows companies like Constellation the option of expanding the fleet of carbon-free nuclear energy in the U.S.

3. NuScale Power

Last year NuScale became the first company to have the design of its reactor, called VOYGR, certified by the Nuclear Regulatory Commission (NRC). Predictably, NuScale has faced a series of challenges. In December, the company was forced to cancel its advanced nuclear pilot project in Idaho due to inflation-related cost increases, unclear regulations from the NRC, and supply chain constraints.

Despite this setback, NuScale is still working to deploy its VOYGR reactor in Poland and Romania over the coming decade. If these pilots are successful and if the nuclear developers face a more friendly regulatory structure in the U.S. NuScale may soon be able to make a comeback in America. NuScale might be down right now, but it is certainly not out.

Outside of dedicated nuclear companies, some tech giants and industrial titans are investing in nuclear power:

1. Microsoft

Last year Microsoft brokered a deal with nuclear power provider Constellation Energy to provide carbon-free power to a Microsoft data center in Virginia. This agreement puts Microsoft closer to accomplishing its goal of running its data centers exclusively on carbon-free power. Last year, the company began training its AI software to navigate regulatory and licensing documents for nuclear power plants, which could reduce costs, streamline projects, and accelerate a nuclear renaissance in the U.S.

2. Amazon

Amazon recently acquired a 100 percent nuclear-powered data center for Amazon Web Services (AWS) for $650 million. Located on a 1,200-acre site, the data center will be powered by Talen Energy’s Susquehanna Steam Electric Station nearby. AWS has signed a nuclear power purchase agreement with Talen to power this massive data center with carbon-free nuclear power for the next decade.

3. Dow

Dow is making great strides to bring advanced nuclear power to the grid, partnering with X-energy to deploy the Xe-100 high-temperature gas reactor at Dow’s Seadrift chemical manufacturing site along the Gulf Coast. This partnership is also being supported by the ARDP.

Venture Fund: Nucleation Capital

This venture fund exclusively invests in advanced nuclear and deep decarbonization technologies, leveraging the expertise of its founders in investment management, tech innovation, and the nuclear industry to identify promising startups in the sector.

Nucleation Capital’s portfolio includes a range of innovative companies working on advanced nuclear and deep decarbonization solutions. Notable investments include Copenhagen Atomics, a Danish developer of a thorium molten salt thermal breeder reactor that turns nuclear waste into fuel, Radiant Nuclear, a Los Angeles-based developer of a micro-modular mobile nuclear reactor, and Deep Isolation, a Berkeley-based company specializing in deep borehole storage of nuclear waste. The fund has also invested in Core Power, a UK-based partner in a Molten Chloride Fast Reactor (MCFR) development consortium with TerraPower, Southern Co., and Orano.

Nucleation Capital provides three investment options: an evergreen fund for accredited investors with quarterly subscriptions starting at $5,000, a traditional venture fund for family offices and institutional investors with a $1 million minimum, and a syndicate platform for deal-by-deal investments with minimums as low as $1,000. By joining the firm’s investor network, individuals gain access to curated investment opportunities in advanced nuclear and related technologies, benefiting from the Nucleation team’s industry knowledge and due diligence process.

For investors who want to put their money into promising nuclear energy companies, there are a growing number of public and private options available. From established players like GE and Constellation to innovative advanced reactor developers, the nuclear renaissance is providing new ways to invest in this zero-carbon energy source. Of course, investing carries risks, and nuclear still faces economic and public perception challenges. But for those bullish on nuclear’s role in the energy transition, adding some exposure to nuclear stocks could be a way to support the sector’s revitalization financially.