Author: THE KERNEL & VLADISLAV

Setting the Scene: State of European Decarbonization

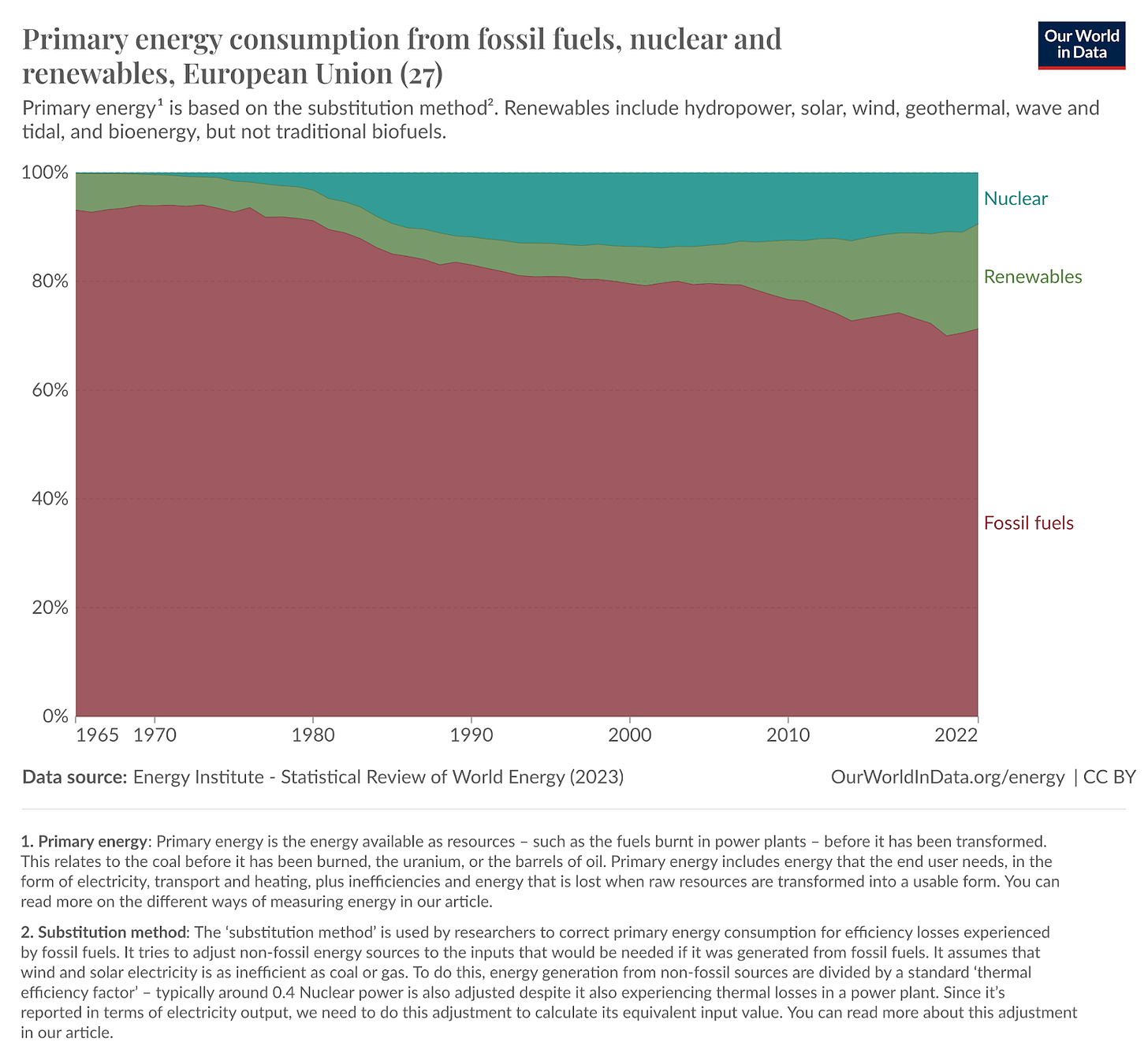

While the power generation sector has made significant progress in reducing emissions, with the share of fossil fuels in the EU(27) energy mix decreasing to around 70% in terms of primary energy consumption (figure 1), the industrial sector requires equal attention to achieve the EU’s climate goals. The recent IETA European Climate Summit, which I was able to attend, played a crucial role in highlighting this often overlooked challenge of decarbonizing Europe’s industrial sector while maintaining its competitiveness.

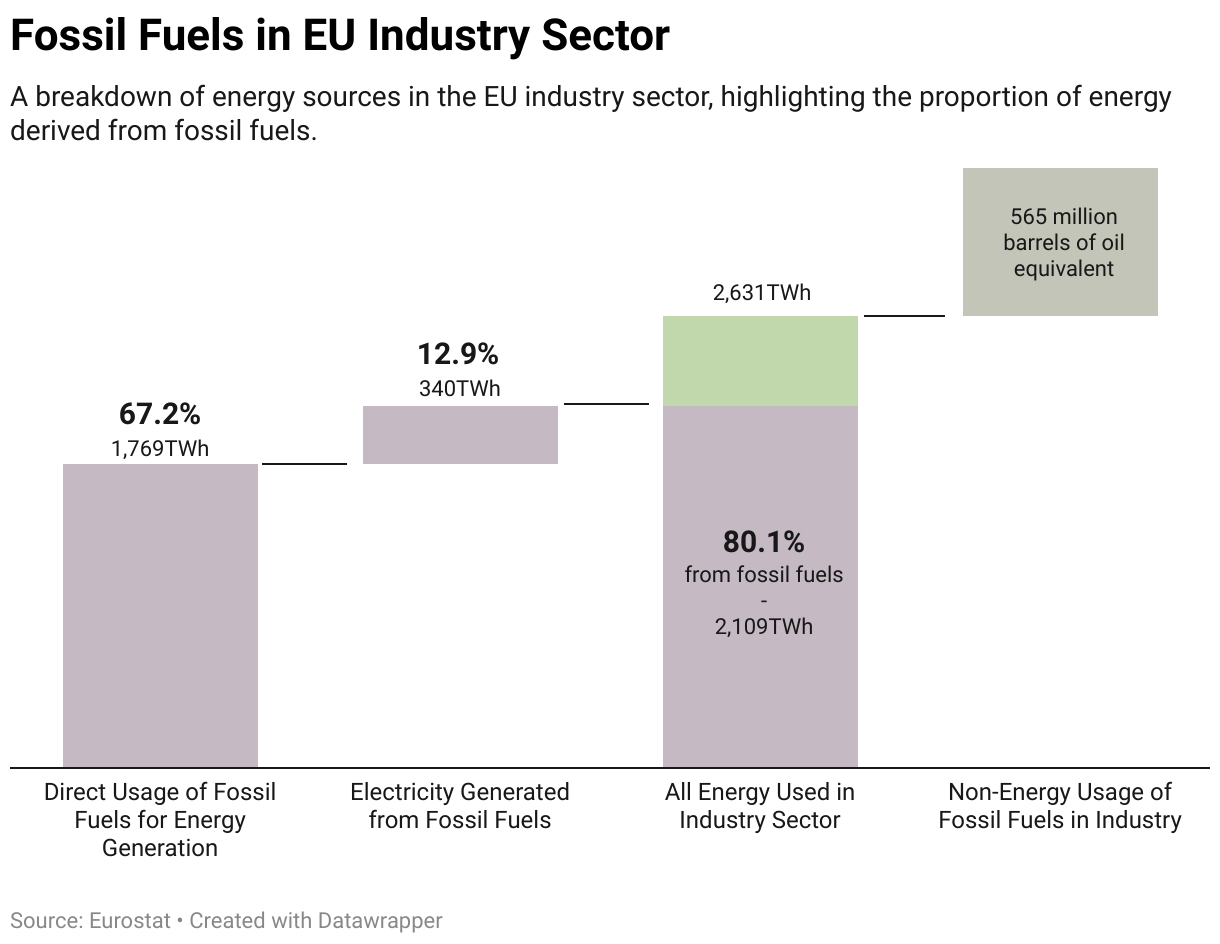

Heavy industries such as cement and steel remain “hard to abate” sectors due to technological and economic barriers. This is mainly due to the non-energy usage of fossil fuels, such as feedstocks for plastics, fertilizer, and steel production, and the high energy intensity of non-fossil alternatives. In the breakdown (figure 2) we can see a detail of the industry sector in EU(27) in 2022.

The G7 has been attempting to address this issue for several years, as evidenced in the 2021 IEA report. Until now, decarbonization efforts in these sectors have largely been achieved by relocating heavy industries outside of Europe and shifting focus to different economic sectors. This strategy has two major drawbacks: firstly, it leads to an increased dependency on international partners, a risk given the current geopolitical climate; secondly, it fails to truly reduce emissions, as they are merely transferred outside of Europe’s jurisdiction.

Europe must find immediate solutions to remain competitive and achieve a net-zero status.

One significant hurdle discussed in Florence at the IETA ECS was the European Carbon Border Adjustment Mechanism (CBAM). Although intended to prevent carbon leakage by applying a carbon price on imported goods, it has several loopholes that undermine its effectiveness. For example, the mechanism does not cover certain processed products or “new scrap,” leading to inconsistencies and potential exploitation of the system. The result is a regulatory framework that struggles to enforce its intended environmental protections while maintaining industry competitiveness within Europe. The new CBAM is supposed to close some of the loopholes, but industry has shown considerable creativity in finding new ones.

Given these challenges, the overarching question remains: How can Europe decarbonize without deindustrializing?

The Role of Nuclear in the Energy Transition

Nuclear energy represents a possible part of the solution in the transition towards a low-carbon economy. At the recent side event to the G7 focusing on nuclear energy’s role, the consensus was clear — nuclear energy can play an essential role for electricity generation, as well as for decarbonizing sectors that are difficult to electrify.

Nuclear power provides a stable, safe, reliable source of energy that can complement the intermittent nature of renewables and decrease storage and transmission requirements. An interesting discussion, following a “Nuclear Industry Statement to the G7”, focused on the application of nuclear energy in heavy industries and non-grid applications, such as hydrogen production and synthetic fuel manufacturing.

Moreover, the current geopolitical climate, marked by increasing energy security concerns, especially post-Ukraine invasion by Russia, highlights the need for an independent and secure energy supply, where nuclear energy could play a significant role.

Despite the growing acceptance of nuclear energy, concerns persist among both the nuclear industry and the general public. The industry itself requires a more stable operational environment, free from political volatility, with well-defined programs and easier access to financing. In terms of political openness, many speakers at the event have noted significant changes post-COP26 in Glasgow. Unlike in the past, when even countries heavily reliant on nuclear power were often hesitant to discuss it openly, nuclear energy can now be addressed civilly, without disruptive protests and interruptions, and with a discourse that is both factual and scientifically oriented. This shift was even more evident at COP28, where nuclear energy was included in the final decision, and a group of countries endorsed the tripling of nuclear capacity. Earlier this year, at the Nuclear Energy Summit, the President of the EU Commission also endorsed nuclear power. With this evolving political landscape, the industry has pinpointed three critical areas that need addressing to achieve these goals: financing, supply chain, and human capital.

- Financing involves expanding access to funds beyond traditional large-scale public financing for big nuclear power plants. Today, with new financial mechanisms and advances in nuclear technology, there’s a substantial opportunity for private and public-private investments. For instance, BPIFrance is moving forward in this direction, among others. Additionally, after 35 years, the European Investment Bank (EIB) is considering resuming its support for nuclear investments.

- Human capital is crucial in the West. Following the extensive nuclear expansion of the last century, interest in the field has waned, leading to a diminished workforce and a loss of expertise. There is now a pressing need for young professionals to specialize in STEM fields, particularly nuclear. This initiative needs to begin in high school, following students through a dedicated educational pathway to ensure a skilled workforce for the future.

- Regarding the supply chain, the keywords are collaboration and an industry-scale approach. Collaboration is essential, especially since only a few countries possess a complete nuclear infrastructure. The inherent stability of nuclear power and its density — requiring small physical spaces for plants and minimal volumes for fuel — help mitigate the impact of geopolitical shifts, providing time to establish new supply chains.

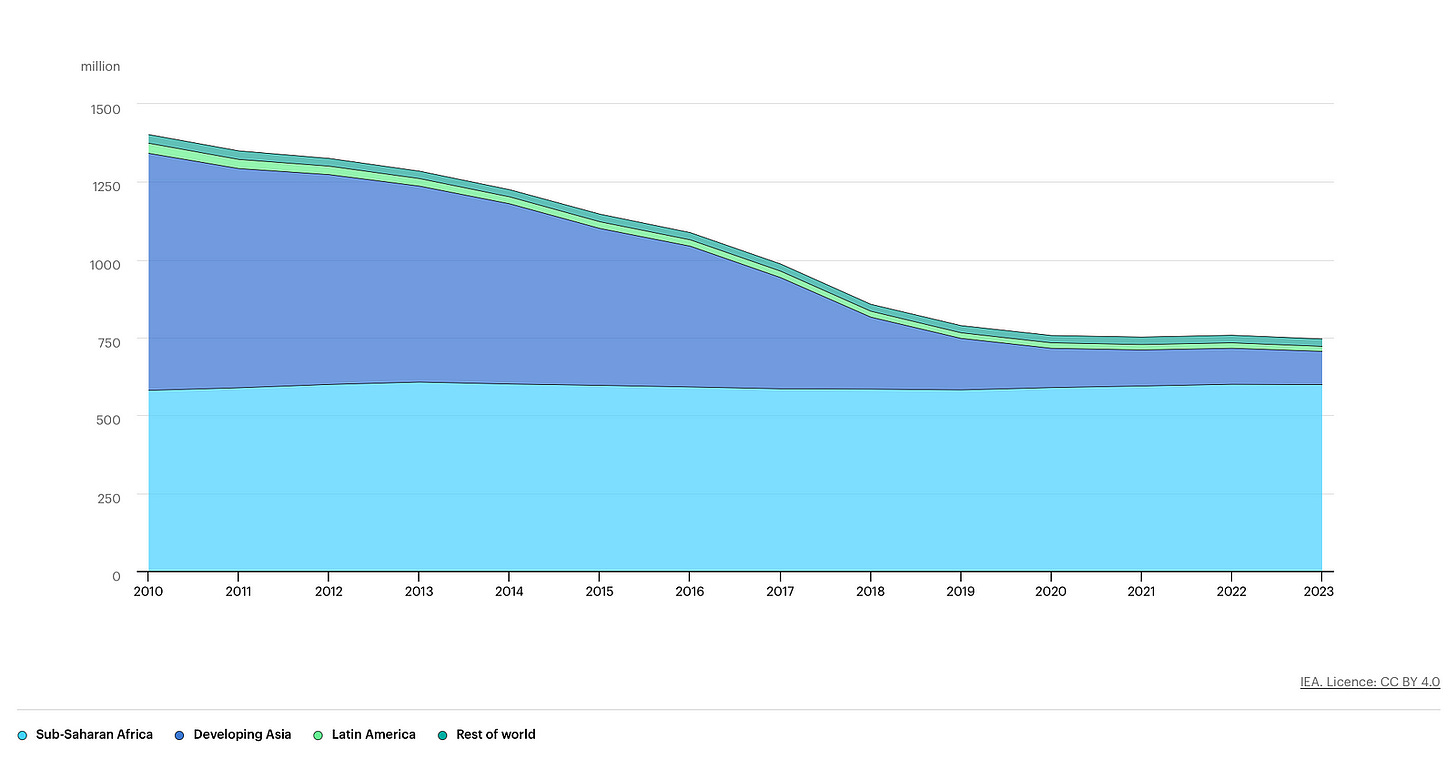

It is important to highlight the African continent, characterized by many developing countries, some of which still have significant portions of their populations without access to electricity (figure 5). As these countries strive for rapid development and energy access, it is crucial that their growth does not continue to default to mostly chaotic, fossil fuel-dependent methods. Nuclear energy, along with renewables, can play a vital role in providing sustainable energy access across the continent. Moreover, collaboration in the field of human capital development can help develop African countries and reinforce the workforce in Western countries.

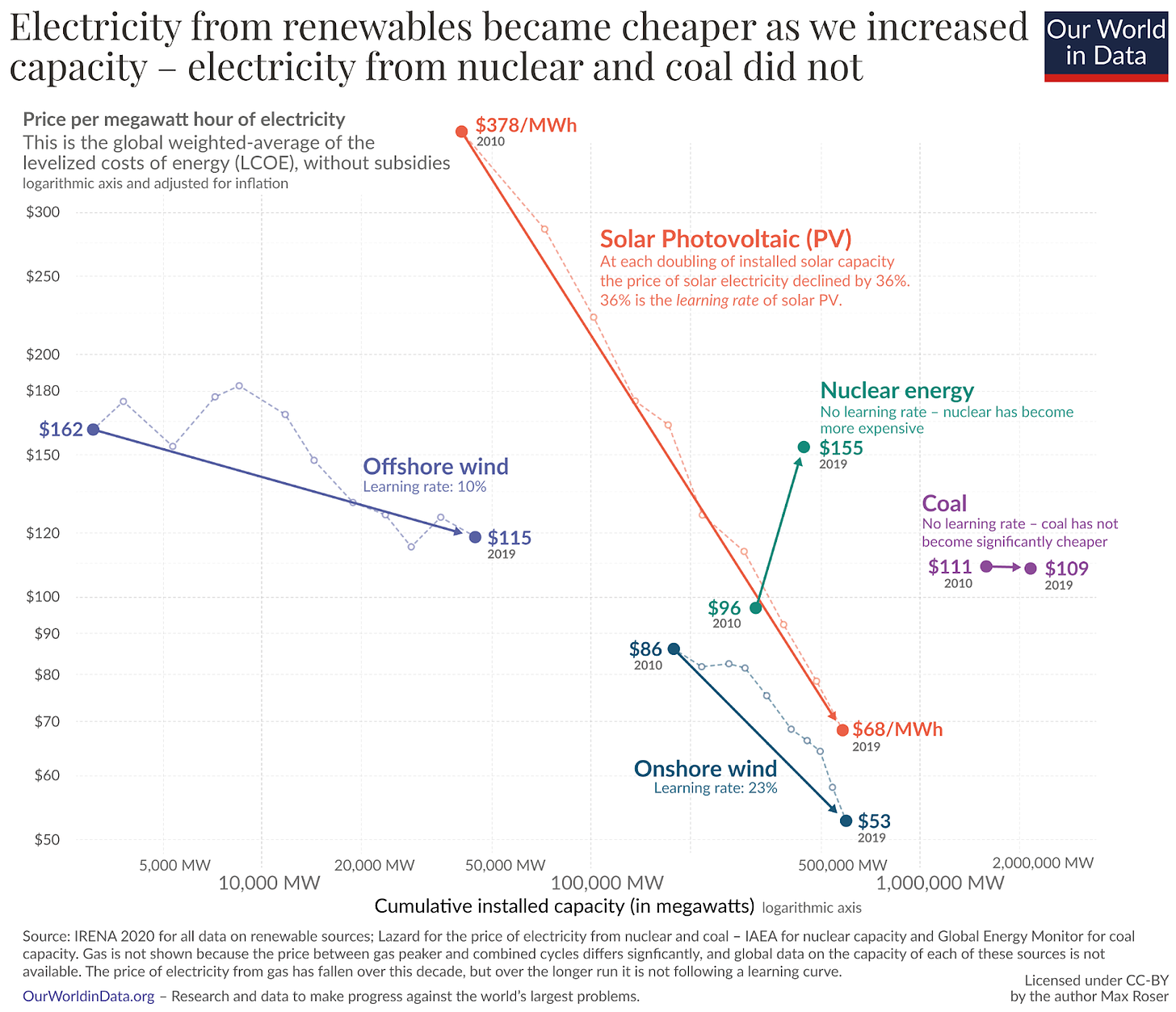

The industry-scale approach is crucial not only for optimizing supply chains but also for addressing the longstanding challenges of nuclear energy, particularly its associated costs. To fully appreciate this perspective, it’s essential to consider the learning curves experienced by different technologies. Significantly, renewable energy technologies have undergone extensive industrialization, leading to rapid deployment and dramatic reductions in costs. This decrease is attributed to both the learning rate and the scale of production within the industry. Over the past decade, the cost of electricity generated from solar photovoltaics (PV) has plummeted by approximately 89%, and onshore wind has declined by about 70% (figure 6).

However, these cost reduction figures should be interpreted with caution. They often reflect only the costs of electricity generation in a vacuum, rather than the complete costs borne by consumers. The commonly referenced Levelized Cost of Electricity (LCOE) has faced scrutiny over the years for sometimes failing to provide an accurate representation of the true economic landscape. Critics argue that traditional LCOE calculations do not adequately account for changes in energy prices over time, which can skew assessments of grid parity — the point at which renewable technologies become economically competitive with conventional power sources without subsidies.

Further complicating the evaluation of renewables is the high degree of uncertainty and variability in the technical and economic performance of emerging technologies. Studies employing global sensitivity analyses have highlighted the substantial impact that uncertainties in input data can have on LCOE values. For well-established energy technologies, such as nuclear or fossil fuels, the variability in LCOE is generally lower due to more predictable capital, operating, and maintenance costs. In contrast, emerging renewable technologies exhibit greater fluctuation in their economic assessments, reflecting their relatively nascent stage of deployment. Introducing factors like carbon pricing into LCOE calculations can also significantly alter the cost-effectiveness landscape, emphasizing the need for a nuanced understanding of life-cycle costs and benefits in energy production.

In light of these complexities, it is evident that the percentage reductions in the costs of renewables should be viewed more as qualitative indicators of progress rather than precise, absolute figures.

Nevertheless, why hasn’t nuclear energy seen similar progress? Although it has been around much longer than solar and wind, nuclear has not undergone a genuine industrialization phase where single designs are produced in quantity. Historically, the approach in the nuclear sector has been to develop unique technologies or spin-offs from existing ones, resulting in a situation where nearly every project is a “first of its kind,” with few being part of a standardized fleet.

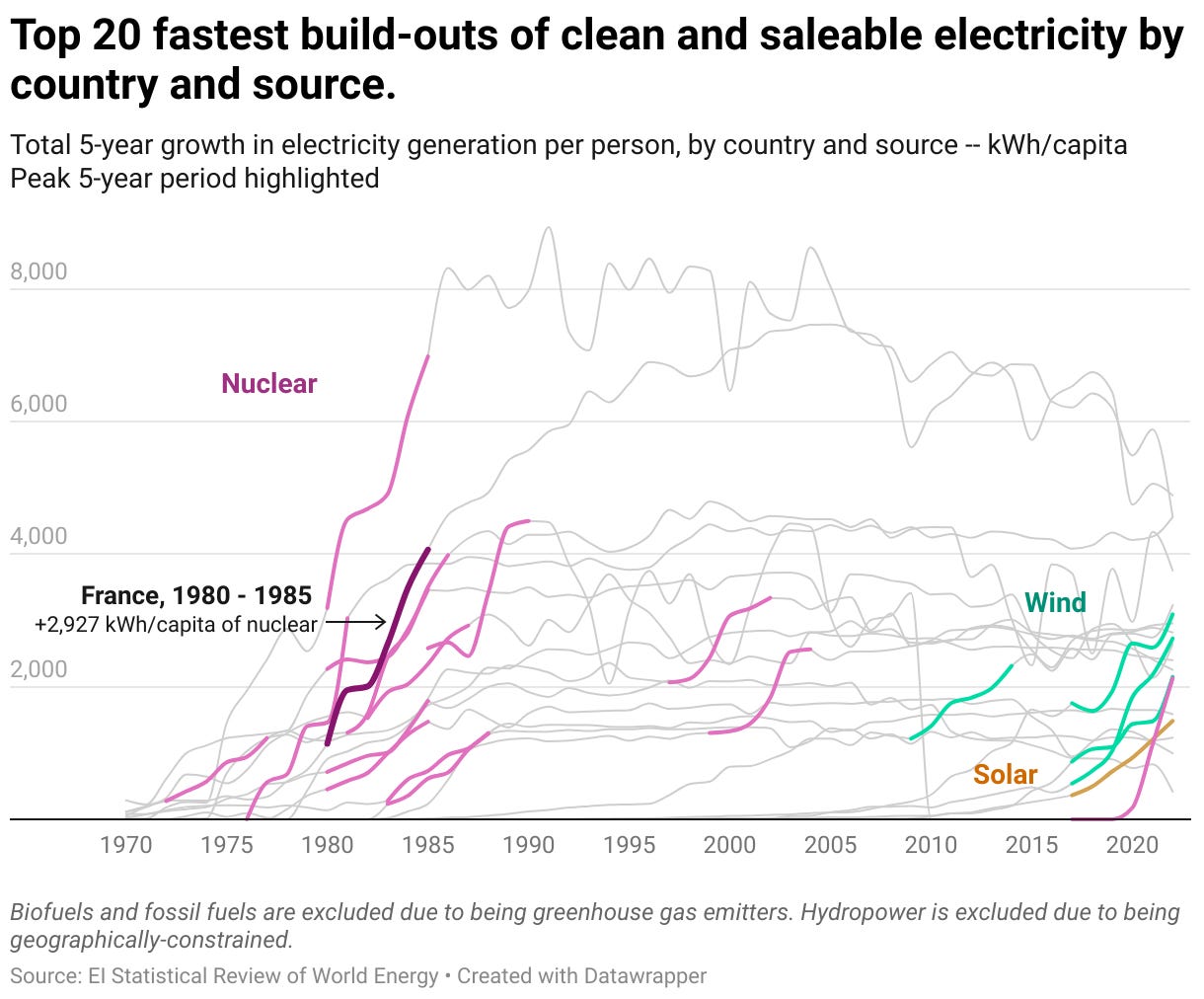

The French nuclear program, a notable historical exception, built 54 nuclear reactors over 15 years, achieving one of the fastest decarbonizations ever seen in an industrialized country. Today, this fleet still operates, providing stable, inexpensive, and clean energy to France and its neighbors.

However, the French nuclear buildout, known as the Messmer Plan, has faced criticism for substantial cost escalations over time despite rapid construction and scale-up. Additionally, it has been characterized by a so-called ‘negative learning’ phenomenon, where costs increased with accumulated experience rather than decreasing. These issues have ignited debates about the efficacy of centralized, technocratic approaches in managing complex, large-scale energy technologies.

Critics of the French approach often argue that the challenges faced could now be overcome. For instance, the financing strategy — relying solely on public spending — and the centralized public management style could be revamped, with different realities attempting or achieving this change, as previously discussed. There is support for the effectiveness of scaling up production — building many identical nuclear power plants (NPPs) to optimize licensing, workforce capacity, regulatory processes, and more. Further support for this strategy is expected from Small Modular Reactors (SMRs), which contrast sharply with the ‘large-scale, lumpy’ technologies requiring significant complexity management in construction and operation, as described by Grubler.

Moreover, recent developments highlight China’s strategy of constructing around 10 plants per year, utilizing existing designs and benefiting from economies of scale. The competitive edge lies in adopting a similar approach: setting annual targets for the number of units built and scaling accordingly.

Another point of success noted in Grubler’s paper is the French program’s ability to construct NPPs in an average of six years. In Japan, TEPCO was able to construct Kashiwazaki-Kariwa 6 and 7, two 1.4GWe boiling water reactors, in 39 and 37 months respectively, both timelines shorter than that of many global projects even nowadays. However, speakers at the G7 side event suggest that even these impressive figures could and should be further reduced. For example, they propose a target of up to a maximum of three years for SMRs, in order to enhance their appeal for private financing.

The lesson here is clear: there is a need to utilize existing, proven, safe, and low-carbon designs and scale them up to meet current and future energy needs, using innovative financing and project management approaches.

The Political Challenge: Towards a Federalist Europe with Ambitious Energy and Industry Plans

The European Union is at a strategic inflection point, requiring a unified approach to tackle the enormous tasks of energy security, economic competitiveness, and climate change mitigation. The concept of a federalist ‘United States of Europe’ — a highly integrated, cooperative entity with agreed common policies on critical issues like energy — could provide the framework needed to effectively address these challenges. Such integration would enable Europe to not only speak with one voice in international arenas, such as the World Trade Organization and international climate negotiations, where it already does so on many occasions, but also to coordinate its industrial and energy strategies more efficiently, avoid internal conflicts and address continent-wide economic issues such as stagnation. This approach would facilitate the creation of specialized industrial hubs across the continent, leveraging the unique strengths and capabilities of each member state.

The nuclear landscape in Europe is complicated: while France is relaunching its nuclear energy program, and countries like Bulgaria and Romania are actively developing theirs, historically anti-nuclear nations such as Italy are slowly becoming pro-nuclear. Meanwhile, traditionally nuclear countries like Belgium and Germany are moving away from nuclear power, with Germany having shut down all of its nuclear power plants.

Germany, in their quest to rapidly decarbonize while phasing out nuclear, has transitioned from being Europe’s industrial powerhouse to the leader of deindustrialization. Without delving into the current state of industry in Europe, there are numerous indicators of shrinking economies. In some cases, such as Germany, this shrinkage is due to misguided policies that have led to soaring energy prices and reduced competitiveness. In other instances, like Italy, it is closely tied to structural economic challenges, notably consistently lower labor productivity compared to other EU and global countries. In general, the traditional approaches seem not to be working.

Can these difficulties be addressed solely by each country on its own? It’s probably best not to find out. As Europe approaches critical elections, a broader rethinking of its political nature becomes not just an option but a necessity. A robust, unified approach to energy, coupled with strategic investments in nuclear power and other clean technologies, offers a path forward. The alternative — fragmentation and deindustrialization — is a fate that Europe can ill afford. The choices made now will define the continent’s trajectory for decades to come.Subscribe

Bibliography

- Hannah Ritchie and Pablo Rosado (2020) — “Energy Mix” Published online at OurWorldInData.org. https://ourworldindata.org/energy-mix

- Eurostat dataset, Regulation (EC) No 1099/2008 on energy statistics

- IEA (2022), Achieving Net Zero Heavy Industry Sectors in G7 Members, IEA, Paris https://www.iea.org/reports/achieving-net-zero-heavy-industry-sectors-in-g7-members

- Greenwashing via CBAM: Loopholes Threaten European Green Products Market https://www.hydro.com/en/about-hydro/stories-by-hydro/greenwashing-via-cbam-loopholes-threaten-european-green-products-market/

- European Union: The new European Carbon Border Adjustment Mechanism https://insightplus.bakermckenzie.com/bm/tax/european-union-the-new-european-carbon-border-adjustment-mechanism

- Nuclear industry statement to the G7 Ministerial Meeting on Climate, Energy and Environment in Turin, Italy (28–30 April 2024) https://cna.ca/wp-content/uploads/2024/04/Nuclear-industry-statement-to-the-G7-Ministerial-Meeting-April-2024.pdf

- https://www.bpifrance.com/2022/02/22/bpifrance-a-key-operator-in-french-investment-plan-france-2030/

- OECD (2012), Nuclear Education and Training: From Concern to Capability https://www.oecd-nea.org/upload/docs/application/pdf/2019-12/6979-nuclear-education.pdf

- Firoz Alam, Rashid Sarkar, Harun Chowdhury, Nuclear power plants in emerging economies and human resource development: A review, Energy Procedia, 2019, https://www.sciencedirect.com/science/article/pii/S1876610219311956

- Max Roser (2020) — “Why did renewables become so cheap so fast?” Published online at OurWorldInData.org. Retrieved from: https://ourworldindata.org/cheap-renewables-growth

- Ulrich Nissen, Nathanael Harfst, Shortcomings of the traditional “levelized cost of energy” [LCOE] for the determination of grid parity, 2019, https://www.sciencedirect.com/science/article/pii/S0360544219300994

- Thomas T.D. Tran, Amanda D. Smith, Incorporating performance-based global sensitivity and uncertainty analysis into LCOE calculations for emerging renewable energy technologies, 2018, https://www.sciencedirect.com/science/article/pii/S0306261918301430

- Arnulf Grubler, The costs of the French nuclear scale-up: A case of negative learning by doing, Energy Policy, 2010, https://www.sciencedirect.com/science/article/pii/S0301421510003526

- Bloomberg, China Able to Accelerate World’s Fastest Nuclear Power Expansion, 2024, https://www.bloomberg.com/news/articles/2024-03-05/2024-china-two-sessions-fastest-nuclear-power-expansion-can-accel

- Mucha-Leszko, Bogumiła, Causes and Consequences of Deindustrialization in the Euro Area, 2016, https://ageconsearch.umn.edu/record/253059?v=pdf

- De-industrialisation in Germany dramatically reduces emissions in 2023 https://www.intellinews.com/de-industrialisation-in-germany-dramatically-reduces-emissions-in-2023-306518/

- Sarra, A., Di Berardino, C. & Quaglione, D. Deindustrialization and the technological intensity of manufacturing subsystems in the European Union. Econ Polit 36, 205–243 (2019). https://doi.org/10.1007/s40888-018-0112-8

- IEA (2023), Number of people without access to electricity by region, 2010–2023, IEA, Paris https://www.iea.org/data-and-statistics/charts/number-of-people-without-access-to-electricity-by-region-2010-2023